All Categories

Featured

Table of Contents

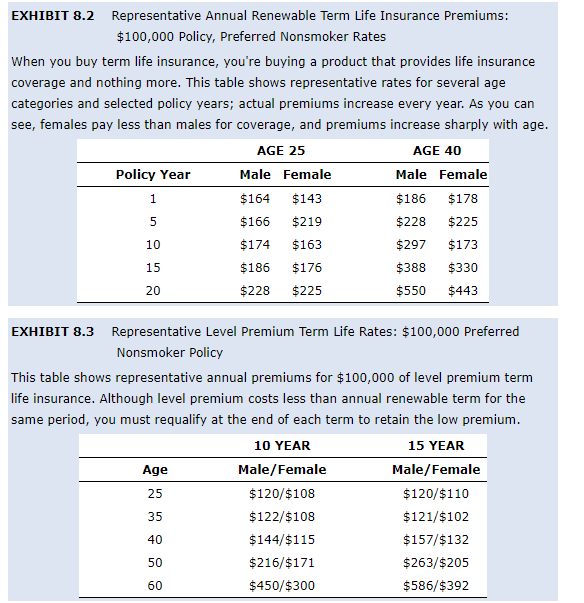

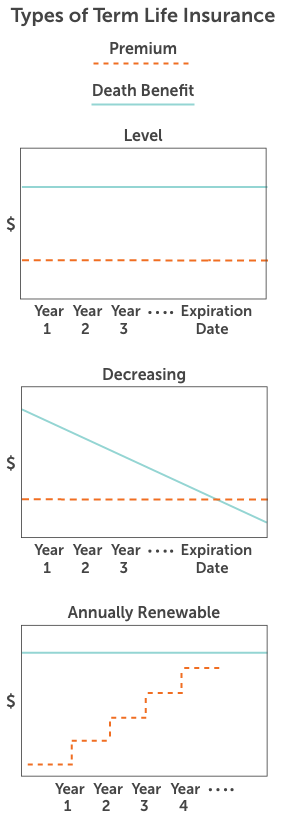

That typically makes them a more budget-friendly choice permanently insurance policy protection. Some term policies may not maintain the premium and survivor benefit the very same gradually. Term life insurance for spouse. You don't want to mistakenly think you're getting level term protection and after that have your survivor benefit adjustment later on. Many individuals obtain life insurance policy protection to help economically shield their liked ones in case of their unforeseen death.

Or you may have the choice to convert your existing term protection right into a long-term policy that lasts the remainder of your life. Different life insurance coverage plans have potential benefits and downsides, so it is very important to comprehend each before you determine to acquire a plan. There are several advantages of term life insurance, making it a preferred choice for protection.

As long as you pay the costs, your recipients will certainly receive the death benefit if you die while covered. That said, it's vital to note that a lot of policies are contestable for 2 years which means protection can be rescinded on death, should a misstatement be discovered in the application. Policies that are not contestable commonly have a rated survivor benefit.

What Makes Increasing Term Life Insurance Stand Out?

Costs are typically reduced than whole life plans. You're not locked into an agreement for the remainder of your life.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

And you can not pay out your plan during its term, so you will not obtain any financial take advantage of your previous protection. As with other types of life insurance policy, the expense of a degree term policy depends upon your age, coverage demands, work, way of life and wellness. Normally, you'll discover a lot more budget-friendly insurance coverage if you're more youthful, healthier and less high-risk to guarantee.

Since level term costs remain the same for the period of insurance coverage, you'll understand exactly how much you'll pay each time. Degree term insurance coverage likewise has some adaptability, allowing you to personalize your plan with additional attributes.

What is Life Insurance? An Overview for New Buyers?

You may have to fulfill specific problems and certifications for your insurance company to establish this biker. On top of that, there might be a waiting duration of approximately 6 months before taking result. There additionally can be an age or time frame on the coverage. You can add a youngster rider to your life insurance coverage policy so it also covers your kids.

The fatality benefit is commonly smaller, and coverage usually lasts till your kid transforms 18 or 25. This motorcyclist might be an extra economical method to help guarantee your kids are covered as bikers can usually cover several dependents at once. Once your youngster ages out of this insurance coverage, it may be possible to transform the cyclist right into a brand-new plan.

When comparing term versus permanent life insurance policy, it's vital to bear in mind there are a couple of different types. One of the most typical kind of long-term life insurance policy is whole life insurance policy, but it has some vital differences compared to level term coverage. Increasing term life insurance. Right here's a basic introduction of what to think about when comparing term vs.

Entire life insurance policy lasts permanently, while term insurance coverage lasts for a particular duration. The costs for term life insurance policy are usually less than entire life coverage. With both, the premiums remain the same for the period of the policy. Whole life insurance policy has a cash value component, where a portion of the premium might grow tax-deferred for future requirements.

One of the primary attributes of level term protection is that your premiums and your death advantage do not transform. You may have coverage that starts with a fatality advantage of $10,000, which might cover a home mortgage, and after that each year, the death benefit will decrease by a collection quantity or percentage.

Due to this, it's usually a much more economical kind of level term insurance coverage., however it may not be sufficient life insurance policy for your demands.

What You Should Know About Annual Renewable Term Life Insurance

After determining on a policy, complete the application. If you're accepted, authorize the documents and pay your initial premium.

Lastly, think about organizing time annually to evaluate your policy. You may wish to upgrade your beneficiary info if you've had any kind of considerable life adjustments, such as a marital relationship, birth or divorce. Life insurance policy can sometimes feel complex. However you don't need to go it alone. As you discover your choices, consider reviewing your demands, desires and concerns with a monetary expert.

No, degree term life insurance coverage doesn't have money value. Some life insurance policy plans have an investment attribute that allows you to develop cash money value over time. A section of your premium settlements is set aside and can make rate of interest with time, which expands tax-deferred during the life of your protection.

However, these plans are commonly considerably more pricey than term protection. If you reach the end of your plan and are still alive, the insurance coverage finishes. You have some options if you still want some life insurance protection. You can: If you're 65 and your insurance coverage has actually run out, for instance, you might intend to buy a brand-new 10-year level term life insurance coverage policy.

What is Direct Term Life Insurance Meaning? What You Need to Know?

You might have the ability to convert your term protection into a whole life policy that will certainly last for the remainder of your life. Numerous kinds of degree term policies are exchangeable. That indicates, at the end of your insurance coverage, you can transform some or every one of your policy to whole life insurance coverage.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. key person insurance for businesses from agents. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

A degree premium term life insurance coverage plan allows you stick to your spending plan while you aid safeguard your family members. Unlike some tipped rate strategies that increases each year with your age, this kind of term plan supplies rates that remain the very same through you select, also as you age or your health adjustments.

Find out more about the Life Insurance policy alternatives available to you as an AICPA participant (Level term life insurance meaning). ___ Aon Insurance Providers is the trademark name for the broker agent and program administration operations of Affinity Insurance Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc .

Latest Posts

Online Funeral Insurance

Final Expense Insurance Vs. Life Insurance

Funeral Insurance Over 60