All Categories

Featured

Table of Contents

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. life insurance for business owners through brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

They normally offer a quantity of insurance coverage for much less than irreversible kinds of life insurance. Like any kind of plan, term life insurance has advantages and downsides depending upon what will certainly function best for you. The advantages of term life consist of cost and the capability to tailor your term length and coverage quantity based on your needs.

Depending upon the kind of policy, term life can use fixed premiums for the whole term or life insurance policy on level terms. The fatality advantages can be taken care of. Because it's an economical life insurance coverage item and the settlements can remain the very same, term life insurance policy policies are prominent with youths just starting, family members and people who desire defense for a specific amount of time.

Comprehensive What Is Direct Term Life Insurance

You ought to consult your tax consultants for your particular factual circumstance. Rates reflect policies in the Preferred Plus Rate Course concerns by American General 5 Stars My agent was really well-informed and helpful at the same time. No pressure to purchase and the process was quick. July 13, 2023 5 Stars I was pleased that all my demands were met immediately and properly by all the representatives I spoke with.

All documents was digitally finished with access to downloading for personal data upkeep. June 19, 2023 The endorsements/testimonials presented must not be taken as a suggestion to acquire, or an indication of the worth of any type of service or product. The testimonials are actual Corebridge Direct consumers that are not connected with Corebridge Direct and were not offered payment.

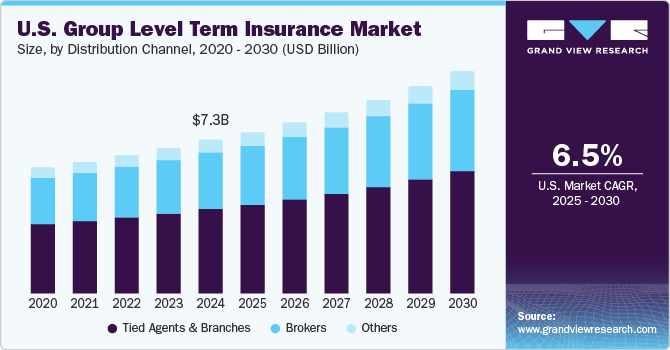

1 Life Insurance Policy Statistics, Data And Industry Trends 2024. 2 Expense of insurance rates are determined using techniques that vary by firm. These rates can differ and will generally enhance with age. Rates for energetic staff members might be various than those available to ended or retired staff members. It's essential to look at all aspects when reviewing the overall competition of prices and the worth of life insurance policy protection.

Tax-Free Term Life Insurance With Accidental Death Benefit

Like many group insurance coverage plans, insurance policy plans supplied by MetLife have specific exemptions, exceptions, waiting durations, decreases, limitations and terms for keeping them in force (joint term life insurance). Please contact your benefits manager or MetLife for expenses and complete information.

For the many part, there are 2 types of life insurance policy prepares - either term or irreversible strategies or some combination of both. Life insurers use different types of term plans and traditional life policies in addition to "interest delicate" products which have actually become more prevalent since the 1980's.

Term insurance supplies defense for a specified time period. This duration could be as short as one year or offer coverage for a particular number of years such as 5, 10, twenty years or to a specified age such as 80 or in many cases approximately the oldest age in the life insurance policy death tables.

Trusted Term Life Insurance With Accelerated Death Benefit

Currently term insurance policy rates are extremely affordable and among the lowest traditionally skilled. It needs to be kept in mind that it is an extensively held idea that term insurance is the least pricey pure life insurance policy coverage available. One requires to evaluate the policy terms carefully to make a decision which term life choices are ideal to fulfill your particular situations.

With each brand-new term the premium is raised. The right to renew the plan without proof of insurability is a crucial benefit to you. Otherwise, the danger you take is that your health might wear away and you might be incapable to acquire a plan at the very same prices or perhaps whatsoever, leaving you and your recipients without coverage.

The length of the conversion period will vary depending on the kind of term plan acquired. The costs rate you pay on conversion is normally based on your "existing acquired age", which is your age on the conversion date.

Under a degree term policy the face quantity of the policy continues to be the exact same for the whole period. With decreasing term the face quantity decreases over the period. The costs stays the same each year. Often such policies are offered as home mortgage security with the amount of insurance coverage decreasing as the balance of the home loan reduces.

Typically, insurers have not deserved to transform premiums after the policy is offered (annual renewable term life insurance). Because such policies might proceed for years, insurers need to use conventional mortality, interest and cost rate price quotes in the costs computation. Flexible costs insurance coverage, nevertheless, permits insurance companies to use insurance policy at reduced "existing" premiums based upon much less traditional presumptions with the right to alter these costs in the future

Secure Direct Term Life Insurance Meaning

While term insurance coverage is developed to supply protection for a defined period, irreversible insurance is created to give protection for your whole life time. To maintain the costs price degree, the costs at the younger ages surpasses the actual cost of defense. This additional costs builds a reserve (money worth) which aids spend for the plan in later years as the expense of security rises over the premium.

Under some plans, costs are required to be spent for an established variety of years. Under other plans, premiums are paid throughout the policyholder's life time. The insurance firm invests the excess costs bucks This kind of plan, which is occasionally called cash money worth life insurance policy, creates a financial savings component. Cash money worths are vital to a long-term life insurance plan.

Expert Level Premium Term Life Insurance Policies

Often, there is no correlation in between the dimension of the cash money worth and the premiums paid. It is the cash worth of the policy that can be accessed while the policyholder lives. The Commissioners 1980 Standard Ordinary Death Table (CSO) is the existing table used in determining minimal nonforfeiture worths and plan reserves for average life insurance policy plans.

Lots of long-term policies will have provisions, which define these tax needs. There are two basic categories of long-term insurance coverage, standard and interest-sensitive, each with a variety of variations. Additionally, each classification is typically offered in either fixed-dollar or variable type. Standard whole life plans are based upon lasting price quotes of cost, interest and death.

If these quotes transform in later years, the company will certainly change the premium appropriately but never over the optimum ensured costs stated in the policy. An economatic whole life plan offers a fundamental quantity of taking part entire life insurance policy with an added supplemental insurance coverage offered with using rewards.

Because the costs are paid over a shorter span of time, the costs settlements will be greater than under the entire life strategy. Solitary premium whole life is minimal payment life where one big exceptional repayment is made. The policy is completely paid up and no additional premiums are needed.

Latest Posts

Online Funeral Insurance

Final Expense Insurance Vs. Life Insurance

Funeral Insurance Over 60