All Categories

Featured

Table of Contents

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. life insurance with cash value growth from brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

There is no payout if the policy runs out prior to your death or you live past the policy term. You may have the ability to renew a term plan at expiration, however the premiums will be recalculated based on your age at the time of revival. Term life insurance policy is generally the least pricey life insurance policy offered since it offers a death benefit for a restricted time and doesn't have a cash money value part like irreversible insurance policy.

At age 50, the premium would certainly rise to $67 a month. Term Life Insurance Policy Fees thirty years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in excellent health. In contrast, below's a consider rates for a $100,000 whole life plan (which is a type of irreversible plan, indicating it lasts your life time and includes cash value).

Passion prices, the financials of the insurance policy business, and state regulations can additionally impact premiums. When you take into consideration the amount of coverage you can obtain for your premium bucks, term life insurance policy has a tendency to be the least pricey life insurance coverage.

He gets a 10-year, $500,000 term life insurance coverage plan with a premium of $50 per month. If George dies within the 10-year term, the policy will certainly pay George's beneficiary $500,000.

If George is diagnosed with an incurable illness during the first plan term, he most likely will not be qualified to restore the policy when it runs out. Some policies offer ensured re-insurability (without evidence of insurability), however such features come with a higher expense. There are numerous kinds of term life insurance policy.

The majority of term life insurance policy has a level premium, and it's the type we have actually been referring to in most of this article.

Reliable Term Life Insurance For Couples

Term life insurance policy is attractive to young individuals with youngsters. Moms and dads can acquire considerable insurance coverage for an affordable, and if the insured passes away while the policy is in effect, the family members can count on the fatality benefit to change lost income. These plans are likewise fit for people with growing family members.

The appropriate selection for you will certainly depend on your needs. Below are some things to take into consideration. Term life policies are ideal for individuals who desire substantial coverage at an affordable. People that have entire life insurance policy pay a lot more in costs for much less insurance coverage however have the safety of understanding they are shielded permanently.

The conversion biker ought to enable you to transform to any kind of long-term policy the insurance coverage firm uses without constraints. The main functions of the rider are preserving the original health and wellness rating of the term plan upon conversion (even if you later on have health concerns or become uninsurable) and making a decision when and exactly how much of the protection to transform.

Of course, general premiums will boost considerably since whole life insurance policy is more expensive than term life insurance. The advantage is the ensured approval without a clinical test. Medical conditions that establish during the term life period can not cause premiums to be enhanced. Nonetheless, the company might require minimal or complete underwriting if you wish to include additional bikers to the brand-new plan, such as a long-lasting care cyclist.

Term life insurance is a fairly affordable method to provide a round figure to your dependents if something occurs to you. It can be a great choice if you are young and healthy and balanced and support a household. Whole life insurance features considerably greater month-to-month premiums. It is indicated to give insurance coverage for as long as you live.

Best Guaranteed Issue Term Life Insurance

Insurance policy business established a maximum age limitation for term life insurance coverage policies. The premium likewise increases with age, so an individual aged 60 or 70 will pay significantly more than a person decades more youthful.

Term life is rather similar to auto insurance policy. It's statistically not likely that you'll need it, and the premiums are cash away if you do not. Yet if the most awful occurs, your household will get the benefits.

One of the most preferred kind is currently 20-year term. Many firms will certainly not sell term insurance policy to an applicant for a term that finishes previous his/her 80th birthday celebration. If a policy is "sustainable," that means it continues effective for an additional term or terms, as much as a specified age, also if the wellness of the guaranteed (or other variables) would cause him or her to be declined if he or she obtained a brand-new life insurance policy policy.

Premiums for 5-year sustainable term can be degree for 5 years, then to a new price showing the brand-new age of the insured, and so on every five years. Some longer term plans will assure that the premium will not increase during the term; others don't make that warranty, enabling the insurer to elevate the price during the plan's term.

This means that the plan's proprietor deserves to transform it into an irreversible sort of life insurance coverage without additional evidence of insurability. In many kinds of term insurance policy, including homeowners and auto insurance, if you haven't had a case under the policy by the time it ends, you obtain no reimbursement of the costs.

Reliable Level Term Life Insurance Definition

Some term life insurance consumers have actually been dissatisfied at this result, so some insurance providers have actually developed term life with a "return of costs" feature. a renewable term life insurance policy can be renewed. The costs for the insurance with this feature are frequently substantially greater than for policies without it, and they usually call for that you keep the plan effective to its term or else you forfeit the return of premium benefit

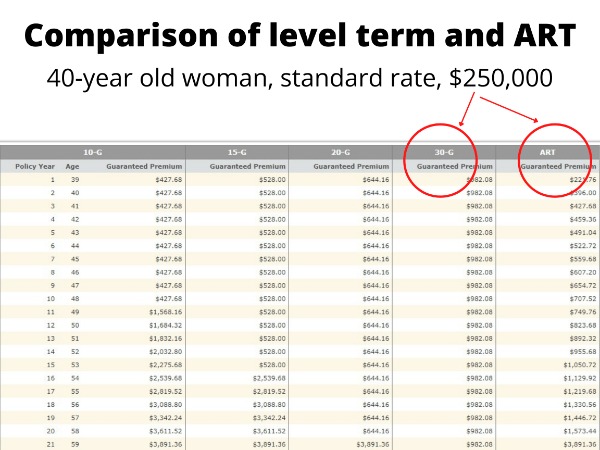

Level term life insurance policy premiums and survivor benefit continue to be constant throughout the plan term. Level term policies can last for periods such as 10, 15, 20 or three decades. Level term life insurance policy is normally a lot more budget-friendly as it doesn't build money value. Degree term life insurance policy is one of one of the most usual kinds of protection.

Coverage-Focused Term 100 Life Insurance

While the names typically are utilized mutually, level term protection has some vital distinctions: the premium and fatality benefit remain the same throughout of insurance coverage. Degree term is a life insurance policy policy where the life insurance policy premium and fatality advantage stay the same throughout of protection.

Latest Posts

Online Funeral Insurance

Final Expense Insurance Vs. Life Insurance

Funeral Insurance Over 60