All Categories

Featured

Table of Contents

A degree term life insurance policy can give you peace of mind that the individuals that depend upon you will have a death benefit during the years that you are planning to sustain them. It's a way to aid deal with them in the future, today. A degree term life insurance policy (in some cases called degree premium term life insurance policy) plan offers coverage for an established number of years (e.g., 10 or two decades) while keeping the costs settlements the same for the period of the plan.

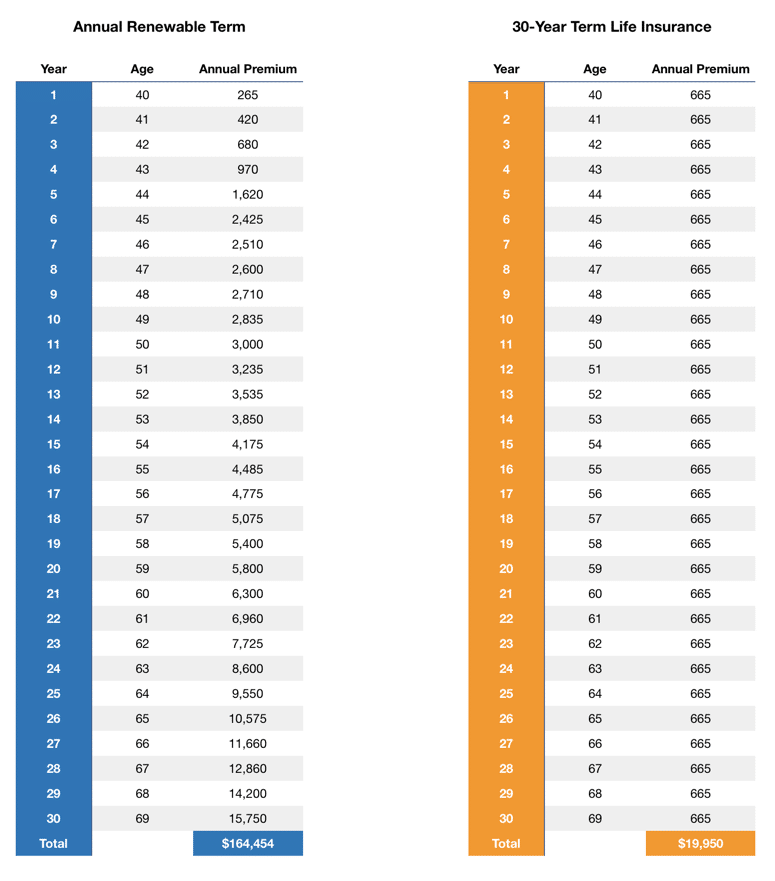

With degree term insurance coverage, the price of the insurance policy will certainly remain the very same (or potentially reduce if rewards are paid) over the regard to your plan, usually 10 or twenty years. Unlike long-term life insurance policy, which never ever expires as lengthy as you pay costs, a degree term life insurance plan will end at some point in the future, usually at the end of the duration of your level term.

The Ultimate Guide: What is Simplified Term Life Insurance?

Due to this, lots of people utilize long-term insurance policy as a stable financial planning device that can offer several needs. You may be able to transform some, or all, of your term insurance policy during a set duration, generally the initial 10 years of your policy, without needing to re-qualify for insurance coverage also if your health and wellness has changed.

As it does, you may intend to include in your insurance policy coverage in the future. When you initially get insurance, you might have little savings and a large home mortgage. At some point, your cost savings will expand and your home loan will certainly diminish. As this occurs, you might intend to at some point decrease your fatality advantage or take into consideration converting your term insurance to a long-term policy.

As long as you pay your costs, you can rest very easy knowing that your loved ones will certainly get a fatality benefit if you pass away during the term. Numerous term policies permit you the capacity to transform to long-term insurance coverage without needing to take another health and wellness test. This can permit you to make use of the extra benefits of a permanent policy.

Degree term life insurance coverage is among the easiest courses right into life insurance policy, we'll go over the advantages and disadvantages to ensure that you can select a plan to fit your needs. Degree term life insurance policy is the most common and basic form of term life. When you're trying to find momentary life insurance policy plans, level term life insurance coverage is one course that you can go.

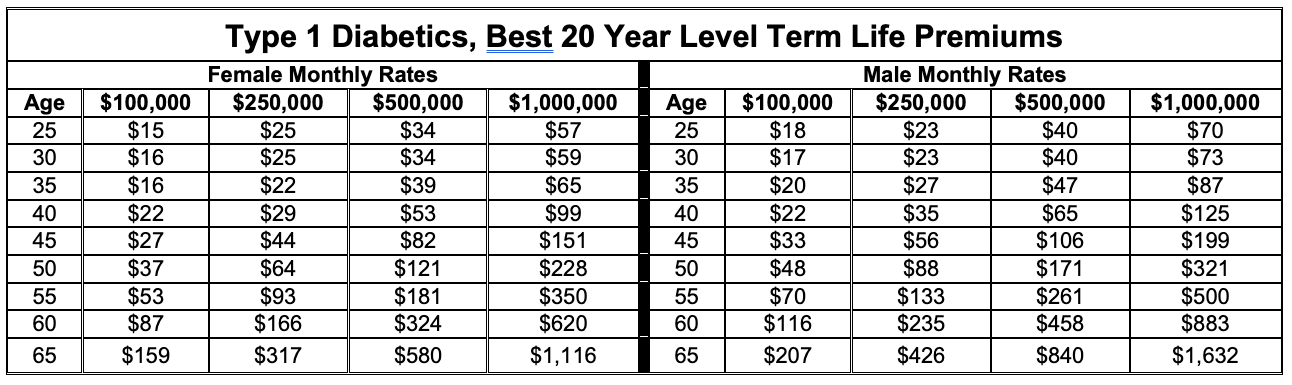

The application process for degree term life insurance coverage is generally extremely uncomplicated. You'll submit an application that includes basic personal info such as your name, age, etc along with a much more detailed set of questions about your medical background. Depending on the policy you want, you may have to take part in a medical exam process.

The short response is no. A level term life insurance plan does not construct money value. If you're wanting to have a policy that you're able to withdraw or borrow from, you may discover long-term life insurance policy. Entire life insurance plans, as an example, let you have the convenience of fatality advantages and can accrue money worth gradually, meaning you'll have a lot more control over your advantages while you're to life.

What is Level Term Life Insurance Definition? Detailed Insights?

Riders are optional stipulations added to your policy that can give you additional advantages and protections. Anything can occur over the course of your life insurance policy term, and you want to be prepared for anything.

There are circumstances where these benefits are built right into your policy, but they can likewise be readily available as a separate addition that calls for added settlement.

Latest Posts

Online Funeral Insurance

Final Expense Insurance Vs. Life Insurance

Funeral Insurance Over 60