All Categories

Featured

Table of Contents

It allows you to budget and prepare for the future. You can conveniently factor your life insurance policy into your spending plan because the costs never change. You can intend for the future simply as quickly because you understand exactly just how much cash your liked ones will certainly receive in case of your lack.

In these situations, you'll generally have to go through a new application process to obtain a much better rate. If you still require insurance coverage by the time your level term life policy nears the expiry date, you have a couple of choices.

A lot of degree term life insurance policy policies feature the alternative to restore insurance coverage on an annual basis after the initial term ends. term vs universal life insurance. The cost of your plan will be based on your existing age and it'll raise yearly. This could be an excellent alternative if you just require to extend your protection for 1 or 2 years or else, it can get expensive rather rapidly

Level term life insurance coverage is among the least expensive coverage choices on the marketplace due to the fact that it supplies basic protection in the form of death benefit and just lasts for a collection amount of time. At the end of the term, it ends. Whole life insurance, on the other hand, is significantly much more expensive than degree term life because it does not expire and includes a money value attribute.

Affordable Decreasing Term Life Insurance Is Often Used To

Prices may differ by insurance provider, term, protection quantity, health course, and state. Level term is a fantastic life insurance policy option for the majority of people, however depending on your insurance coverage demands and individual situation, it could not be the finest fit for you.

This can be a great option if you, for instance, have simply quit cigarette smoking and require to wait two or three years to use for a level term policy and be eligible for a lower price.

Reputable Level Term Life Insurance

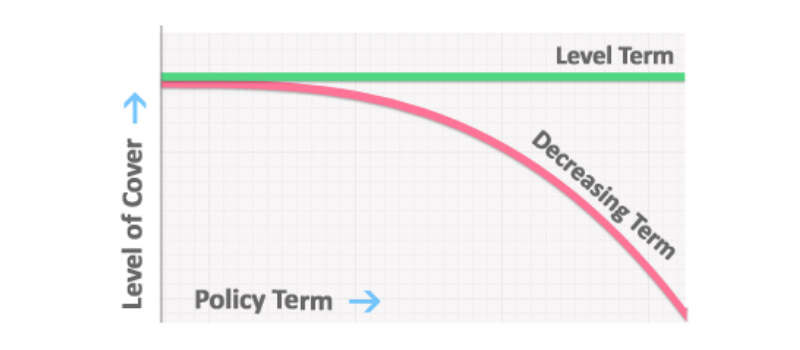

With a reducing term life policy, your fatality benefit payment will lower in time, however your payments will remain the same. Decreasing term life policies like home mortgage protection insurance coverage generally pay to your loan provider, so if you're looking for a plan that will certainly pay to your liked ones, this is not a great fit for you.

Increasing term life insurance policy plans can assist you hedge versus inflation or strategy financially for future children. On the various other hand, you'll pay more ahead of time for much less protection with an increasing term life policy than with a level term life policy. If you're uncertain which kind of plan is best for you, collaborating with an independent broker can aid.

As soon as you have actually determined that degree term is right for you, the following step is to purchase your policy. Below's how to do it. Compute just how much life insurance policy you require Your coverage amount ought to offer your household's lasting economic requirements, including the loss of your earnings in the event of your death, as well as debts and everyday expenses.

A degree costs term life insurance policy plan allows you stick to your budget plan while you help protect your household. ___ Aon Insurance Policy Providers is the brand name for the brokerage and program administration procedures of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Company, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Policy Providers Inc.; in CA, Aon Fondness Insurance Coverage Services, Inc.

The Strategy Representative of the AICPA Insurance Policy Depend On, Aon Insurance Services, is not associated with Prudential.

Latest Posts

Online Funeral Insurance

Final Expense Insurance Vs. Life Insurance

Funeral Insurance Over 60